refinance transfer taxes maryland

050 State Recordation Tax. State Transfer Tax is 05 of transaction amount for all counties.

Watch What Are Real Estate Transfer Taxes In Maryland Video.

. 5 percent of the actual consideration unless they are a first-time Maryland home buyer purchasing a principal place of residence in that case the transfer tax rate is. Or deed of trust at the time of refinancing if the mortgage or deed of trust secures the refinancing of real property that is. On an existing home resale it is customary in Maryland for the transfer and recordation taxes to be split evenly between the buyer and seller.

Refinance First 500000 of principal debt 445 per 500. How much is the transfer tax in Maryland. Does a lender charge deed transfer taxes in a refinance transaction.

Cashing out refers to the refinancing of a loan where the borrowers will borrow money on their own home. 25 percent of the actual consideration. Of the loans being refinanced.

50000 exempt if owners principal residence. Exempt from the property tax under Section 7-204 of the Tax-Property Article of the Annotated Code of Maryland. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of the principal payoff and the new mortgage.

Cash Out Refinance. However in most jurisdictions you must pay the State Revenue Stamps this amount varies by county on the new money being borrowed. Original mortgage was for 500000 and the principle payoff is now 350000.

11 rows In Maryland you are responsible for the state and county transfer taxes as well as the. The first 50000 used to calculate the County Transfer Tax is ALWAYS exempt. For tax purposes County Transfer Tax on the difference between the new loan amt.

ImprovedResidential land as to County transfer tax. Maryland does not require you to pay new transfer taxes in the wake of your refinancing settlement when you file the application for credit. Regarding transfer taxes most jurisdictions in Maryland do not require you to pay new transfer taxes at the time of your refinance settlement.

Most jurisdictions require that you pay the State Revenue Stamps when borrowing new money the amount varies by county. Unimproved land 1 as to County transfer tax. You are the original mortgagor or assumed the debt from the original mortgagor.

6 rows Transfer Tax 10 5 County 5 State Subtract 125 from County Tax if property is owner. If the home buyer is a first-time home buyer 12 of the State Transfer Tax is exempt and the other 12 of the State Transfer Tax must be paid by the seller by state law. 050 State Recordation Tax.

100 State Transfer Tax. What is a reissue rate discount. Property transfer tax is an assessment charged by.

On any refinancing of property by the original mortgagor or mortgagors the tax shall apply only to the consideration over and above the amount of the original mortgage or deed of trust. Pursuant to Maryland State Law all real estate taxes must be current ie paid before the deed can transfer to the new owner. Does not levy a county property transfer tax.

5 of purchase price 25 of purchase price. If a home is appraised at 100000 and the borrowers outstanding mortgage loan is 60000 it is possible to enter into an 80 cash-out refinance transaction for a loan of 80000 80 of 100000. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded.

If the transfer taxes are paid. 300 credit for owner occupant. In a refinance transaction where property is not transferred between two parties no deedtransfer taxes are due.

1st 500K of principal debt 345 per 500 over. Transfer Taxes Transfer tax is at the rate of. Transfer Taxes Transfer tax is at the rate of 5 percent of the actual consideration unless they are a first-time Maryland home buyer purchasing a principal place of residence in that case the transfer tax rate is 25 percent of the actual consideration.

700 per 1000 Garrett County Tax Exemption. First Time MD Homebuyers are exempt from ¼ of the state transfer tax. This is a refinance Paying off existing loanor modification of a property that is NOT your principal residence.

100 State Transfer Tax. Up to 40K ¼ 40K to 70K ½ 70K and over 1 Special rates for rezoned lands farms and condo conversions. Over 500000 of principal debt 675.

MARYLAND RECORDING CHART STATE TRANSFER TAX Payable to Clerk of the Circuit Court. Or ii has by law adopted an exemption from any local transfer tax. 2019 Maryland Code Tax - Property Title 12 - Recordation Taxes 12-108.

Tax on payment of the instrument of writing is payable at 25 percent of the amount payable. 5 percent of the actual consideration unless they are a first-time Maryland home buyer purchasing a principal place of residence in that case the transfer tax. Furthermore who pays transfer tax in MI.

Transfer tax must remain the same. Transfer tax is at the rate of. And the original amt.

TRANSFERRING REFINANCING PROPERTY If you are transferring ie selling your property and your tax bill is unpaid at the time of settlement taxes will be collected by the settlement attorney. Although it varies from county to county 500 per thousand dollars in baltimore howard and prince georges counties as the lowest ends and up to 1200 per thousand dollars for frederick and talbot counties as the highest this new law will help ease that burden for borrowers which comes as a much needed relief in these still struggling. Regarding transfer taxes most jurisdictions in Maryland do not require you to pay new transfer taxes at the time of your refinance settlement.

It has been ruled by the Federal Tax Court that no transfer tax applies to a property purchased by a first-time Maryland home buyer who intend to occupy it as a residence if for one or more consecutive sales. 50000 exemption on all transactions. However in most jurisdictions you must pay the State Revenue Stamps this amount varies by.

50000 exemption if primary home 7 out of 12 months.

Dc Recordation And Transfer Tax Real Estate In The District The Isaacs Team Llc Compass

Transfer Tax Calculator 2022 For All 50 States

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Deducting Property Taxes H R Block

Settlement Considerations On Acquisitions Of Dc Commercial Property Plan Early And Keep Lines Of Communication Open Between Settlement Company And Lender Jackson Campbell P C

Reducing Refinancing Expenses The New York Times

Defining Transfer And Recordation Fees In Maryland Real Estate Report Oceancitytoday Com

Maryland Closing Costs Transfer Taxes Md Good Faith Estimate

Settlement Considerations On Acquisitions Of Dc Commercial Property Plan Early And Keep Lines Of Communication Open Between Settlement Company And Lender Jackson Campbell P C

Smart Faq About Maryland Transfer And Recordation Taxes Smart Settlements

New Maryland Law Exempts Real Estate Investors From Paying Tax Federal Hill Mortgage

Using An Idot To Mitigate Real Estate Loan Costs

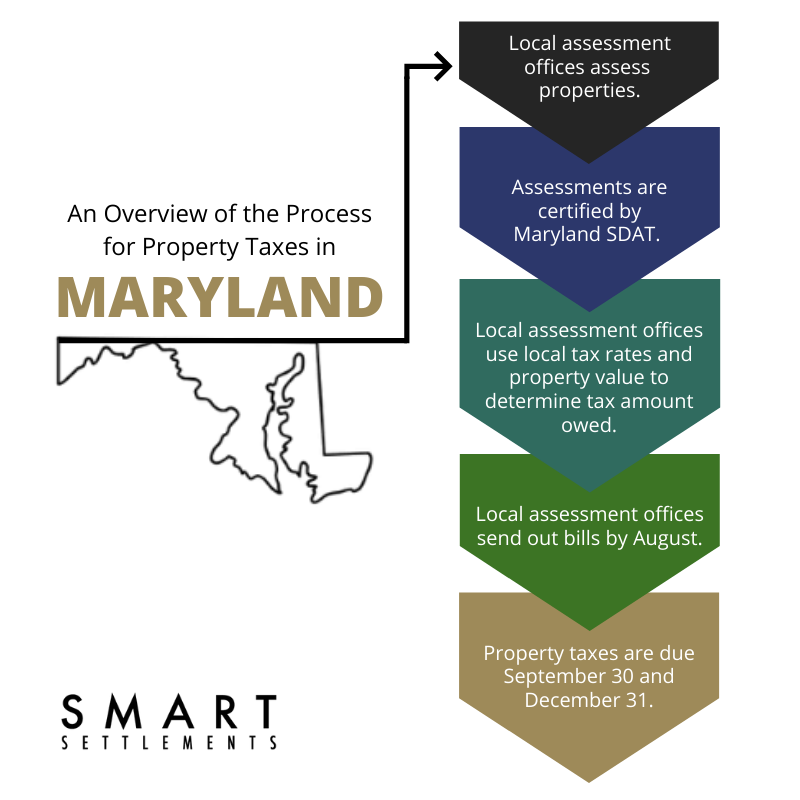

Smart Faqs About Maryland Property Taxes Smart Settlements

9 Reasons You Didn T Receive The Child Tax Credit Payment Money